Understanding Rate Buydowns: How They Work and When They Make Sense

If you’re exploring mortgage options, you may have heard the term “rate buydown” tossed around. It’s a tool some homebuyers use to lower their interest rate, but how exactly does it work? Let’s break it down.

What Is a Rate Buydown?

A rate buydown is when you pay extra money upfront—called points—to reduce the interest rate on your mortgage. Essentially, you’re pre-paying interest in exchange for a lower monthly payment.

-

1 point = 1% of your loan amount

-

Each point generally lowers your interest rate by 0.25%, though this can vary by lender

For example, if your mortgage is $300,000 and you pay 2 points ($6,000), you might lower your interest rate from 6% to 5.5%. That could save you hundreds of dollars per month in mortgage payments.

Types of Rate Buydowns

There are two main types:

1. Permanent Buydown

This lowers your interest rate for the life of the loan. You pay the upfront cost once, and your monthly payments stay lower throughout the mortgage term.

2. Temporary Buydown

This lowers your interest rate for a limited time, often the first 1–3 years of the loan. A common example is a 3-2-1 buydown, where the rate starts 3% lower in year one, 2% lower in year two, and 1% lower in year three before returning to the original rate.

Temporary buydowns are popular with builders or sellers who offer incentives to make homes more affordable for buyers initially.

Pros of a Rate Buydown

-

Lower monthly payments

-

Easier to qualify for a mortgage if your debt-to-income ratio is tight

-

Can save significant money over time (especially with permanent buydowns)

Cons of a Rate Buydown

-

Upfront cost can be high

-

May not be worth it if you plan to sell or refinance soon

-

Temporary buydowns only offer short-term savings

Is a Rate Buydown Right for You?

A rate buydown can make sense if:

-

You have cash available for upfront costs

-

You plan to stay in your home long enough to recoup the cost

-

You want lower payments initially to manage your budget

It’s always important to calculate your break-even point—the time it takes for the monthly savings to equal the upfront cost—to determine if it’s financially worthwhile.

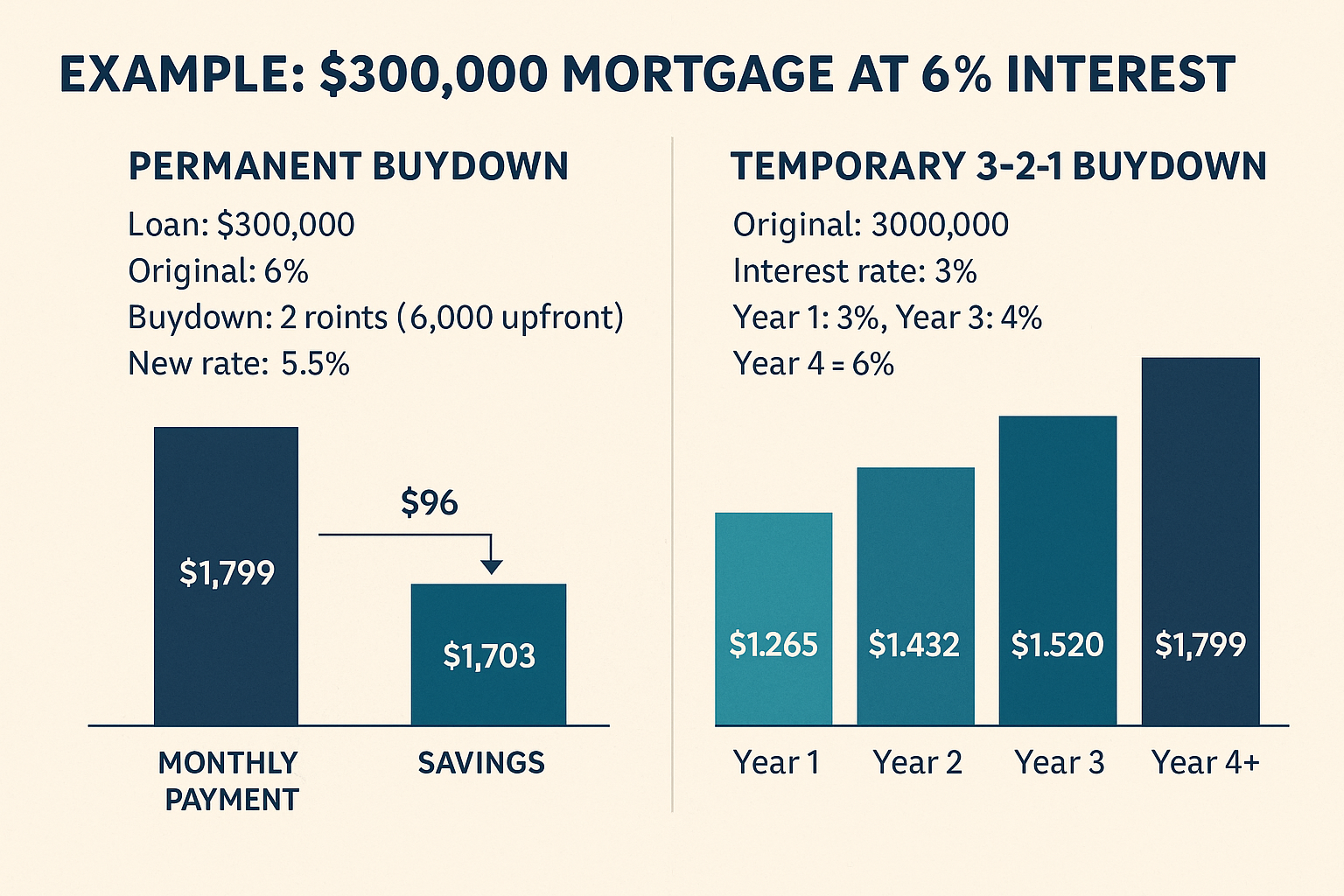

Example: $300,000 Mortgage at 6% Interest

1. Permanent Buydown

-

Loan: $300,000

-

Original rate: 6%

-

Buydown: 2 points ($6,000 upfront)

-

New rate: 5.5%

Monthly Payment (Principal & Interest):

-

At 6%: $1,799/month

-

At 5.5%: $1,703/month

Monthly Savings: $96

Break-even: $6,000 ÷ $96 ≈ 62.5 months (~5 years, 2 months)

✅ If you stay in the home longer than 5 years, you save money.

2. Temporary 3-2-1 Buydown

-

Loan: $300,000

-

Original rate: 6%

-

Buydown: seller or builder pays upfront to reduce rate for first 3 years

Interest Rate by Year:

-

Year 1: 3%

-

Year 2: 4%

-

Year 3: 5%

-

Year 4+: 6%

Monthly Payment (Principal & Interest):

-

Year 1: $1,265/month

-

Year 2: $1,432/month

-

Year 3: $1,520/month

-

Year 4+: $1,799/month

Savings:

-

Year 1: $534/month

-

Year 2: $367/month

-

Year 3: $279/month

💡 Great for buyers who need lower payments initially or for homes with builder incentives.

Key Takeaways:

-

Permanent buydowns are better if you plan to stay in the home long-term.

-

Temporary buydowns are perfect for short-term relief or new home incentives.

-

Always calculate your break-even point to see if the upfront cost makes sense.

Bottom Line:

Rate buydowns are a flexible tool to make your mortgage more affordable. Whether permanent or temporary, they allow buyers to pay a bit more upfront for long-term—or short-term—savings. Always weigh the upfront cost against how long you plan to stay in the home to see if a buydown is the smart choice for your situation.

Would your like more information about buying a home? GET YOUR FREE-HOMEBUYERS GUIDE HERE ➡️ Get your guide

By: Mark Comparato

Broker Associate- Call The Comps Real Estate Team at REAL BROKER, LLC

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

2355 Hwy 36 West, Suite 439, Roseville, Minnesota, 55113, USA